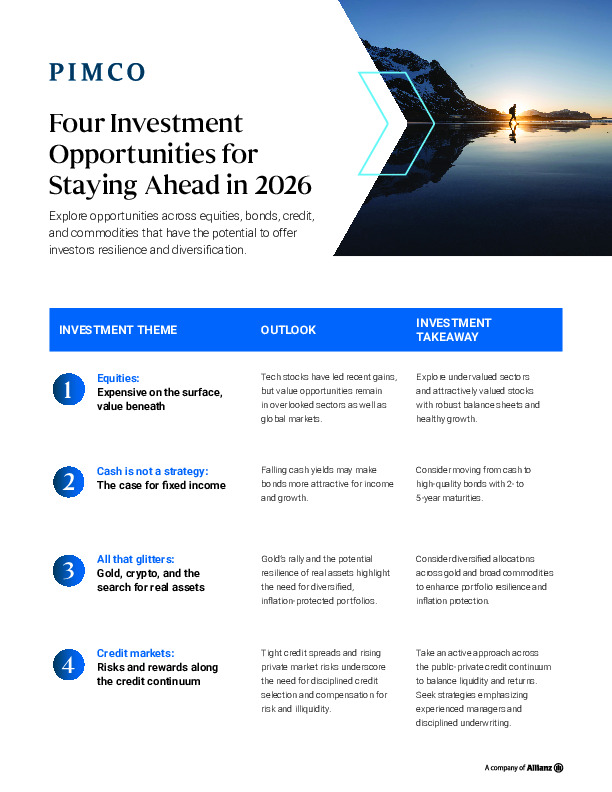

The featured report outlines a cross-asset framework to help investors stay ahead in 2026, drawing on macro, valuation, and liquidity dynamics across global markets.

-

Equities appear expensive at the index level, but selective value persists across sectors and regions with stronger balance sheets.

-

As cash yields decline, high-quality fixed income regains appeal for income, diversification, and downside resilience.

-

Tight credit spreads and elevated private-market risks call for disciplined, active positioning across public and private credit.

The full note details how these themes interact—and where portfolios can be repositioned as late-cycle risks and opportunities converge.

Um diesen Artikel zu lesen, benötigen Sie ein Abonnement für Investment Officer. Falls Sie noch kein Abonnement haben, klicken Sie auf 'Abonnieren', um die verschiedenen Abonnementoptionen anzuzeigen.